[ad_1]

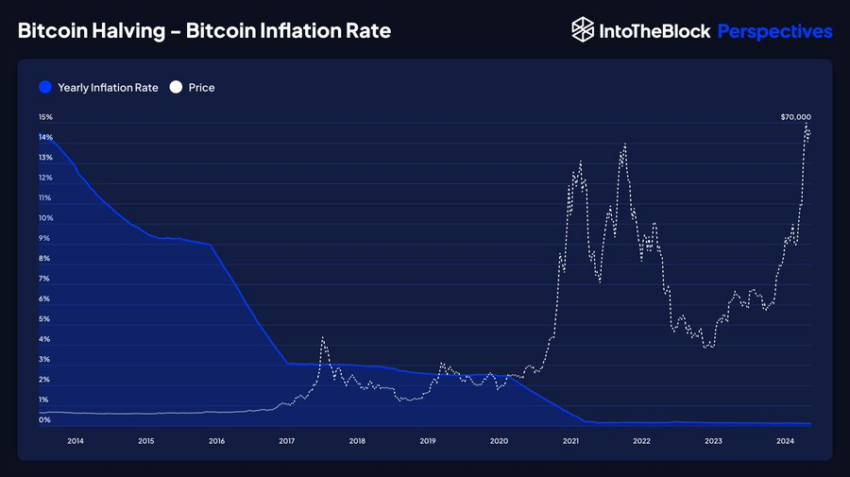

On April 20, Bitcoin will undergo its anticipated halving. This four-yearly occurrence slashes mining rewards by half, with the upcoming one reducing rewards to 3.125 BTC per block.

The timing of the halving is particularly intriguing as it unfolds amidst a bullish trend in Bitcoin’s price. Analysts anticipate this halving could substantially influence Bitcoin’s trajectory in the coming years.

Is Now the Best Time To Buy Bitcoin?

Bitcoin surged by 67% in the initial quarter of 2024, driven predominantly by heightened demand for Bitcoin exchange-traded funds (ETFs). The substantial price growth already experienced now prompts discussions regarding the potential impact of Bitcoin halving.

Some analysts argue that Bitcoin remains undervalued, foreseeing a potential climb to $100,000 within the year. The remarkable performance of the asset thus far, coupled with anticipated rate cuts from the Federal Reserve, renders this projection plausible.

“We could see a brief correction, but as central banks ease up on monetary policy, that should drive both direct Bitcoin sales and ETFs because Bitcoin tends to behave like a tech stock or speculative asset, which generally see gains around easing of monetary policy. My estimate is that Bitcoin could reach anywhere from $100,000 to $150,000 in 12 to 18 months post-halving,” Jason Fernandes, co-founder at AdLunam told BeInCrypto.

Conversely, other experts suggest that the market has already factored in the halving. Yet, with Bitcoin’s supply poised to decrease and Bitcoin ETF-driven demand steadily rising, some view the current juncture as opportune for Bitcoin investment.

Read more: Bitcoin Halving Countdown

Researchers at NYDIG contend that the impact of the Bitcoin halving on prices may be marginal compared to the influence of ETF demand. Consequently, they anticipate that the approximately 450 BTC in daily supply will not exert significant pressure on prices.

“While the halving event may not serve as an immediate price catalyst, historical data suggests that it plays a vital role in shaping Bitcoin’s price cycles. Typically, there is a lead-up to the halving followed by substantial returns post-event. With the current positive price performance pre-halving, investors have reasons to be optimistic about the future potential of Bitcoin,” NYDIG’s Greg Cipolaro wrote.

Nevertheless, historical data reveals a diminishing percentage increase following each halving. After the first halving, Bitcoin soared from $13 to $652, marking a staggering 4,802% surge. Subsequent halvings have yielded reduced percentage increases, hinting at a similar pattern this time.

Read more: Bitcoin Price Prediction 2024/2025/2030

Still, Fernandes told BeInCrypto that Bitcoin’s performance post-halving has differed due to different macro-economic events.

“2012’s Bitcoin halving event saw limited investment by tech-savvy individuals and niche communities. In 2016 we saw an increased awareness of Bitcoin as an alternate currency that would withstand economic instability. The pandemic year of 2020 was a bit of an outlier as the halving was offset by a terrible overall financial situation. In sum. I would say the effects of the halving tend to be evenly split between macro-economic factors prevalent at the time,” Fernandes explained.

The nuanced perspectives highlight a broader consensus that, while the immediate impact of the halving on BTC’s price may be debatable, the event is crucial for setting the stage for future price cycles. Still, the major effects of this event will be seen on miners’ profitability amid escalating energy expenses.

However, insights from IntoTheBlock indicate that miners’ revenue, measured in USD, is presently at a peak, propelled by Bitcoin’s rising value. If the halving precipitates further value appreciation, the diminished rewards may have negligible repercussions on miners.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link

Be the first to comment